For a Green Island .. Fandom

2023-10-04Chicken Road Slot review: Is it worth the Hype?

2024-04-10The financial institution may also require a letter of recommendation from another financial institution, particularly if the individual has no financial historical past in the UAE. For these with a resident visa, opening an account is comparatively simple. Residents, which embrace employees working within the UAE, business homeowners and their families, can gain full access to banking merchandise. For workers, all that’s normally required is a passport, a resident visa and proof of employment, similar to a certificates https://execdubai.com/ from an employer.

Accounts with lively loans cannot be closed till an alternate method of payment is organized, or the loan is settled. If you’re a scholar juggling examine alongside work and social commitments, ensuring you’ve reliable and quick access to your cash is essential.Choosing a… The steps, options and necessary need-to-knows earlier than your start. A cheaper option is to use Wise which offers the real, mid-market change rate. As you’ll making any major monetary decision, ensure to thoroughly read all the documents your agent presents to you before signing. If account closure occurred with out critical violations and without reporting to the Central Bank of the UAE, the potential for opening a brand new account at one other UAE bank generally stays.

In Dubai, you’ll have the ability to open private savings accounts, present accounts, and business accounts. Each kind has totally different options, corresponding to interest rates, minimal balances, and transaction limits. Personal banking accounts are usually meant for shoppers with excessive earnings ranges and vital property. This service format contains a broader range of banking providers, a person approach, and an enhanced level of customer support. These accounts typically contain substantially greater minimal stability necessities or assets underneath administration thresholds, which may differ relying on the financial institution and the selected service program.

What Documents Are Required To Open A Wage Checking Account In Dubai Uae?

We can characterize you if you cannot meet the Contact Level Verification Agent. To simply and reliably examine on the mid-market change rate between your home forex and UAE Dirhams, use an online foreign money converter. You’ll additionally have the power to see how the market’s been trending during the last 30 days and see what your cash is definitely worth. Contact Aljazat right now to debate your banking wants and get began on your journey to financial freedom in the UAE. Here’s what the schedule of expenses can appear to be for a medium-priority account with a month-to-month average stability of AED 5,000. The greatest approach to start a enterprise in UAE is to rent top-of-the-line business consultants.

benefits Of A Uae Bank Account

Navigating the banking panorama and paperwork could be a daunting task. Aljazat streamlines this complete process, appearing as your trusted associate. We work with you to prepare all essential paperwork registration of company in dubai, liaise immediately with bank representatives, and guarantee your software meets all the regulatory requirements. Our aim is to make opening your bank account a seamless and stress-free expertise. In follow, it’s difficult to open an account in the UAE for non-residents. In many instances, they’ll both refuse foreigners or set further circumstances.

- A visit to the financial institution is a chance to fill out an account application and current paperwork.

- Our team maintains prompt communication with financial institution representatives to streamline the process.

- Offshore accounts, obtainable to UAE residents with a legitimate visa, supply safe and tax-efficient banking options.

- Commonplace Chartered, Royal Financial Institution of Canada, Habib Bank, HSBC and Citibank are all major international banks that function within the UAE, any of which might be a good selection if you’re moving to Dubai.

- It’s attainable to problem an international debit or credit card for free.

Minimal Balance Charges

Credit Score playing cards https://acappellas.co.uk/greatest-visa-company-dubai-professional/ are usually obtainable to UAE residents with a monthly wage of AED 5,000 or extra, relying on the financial institution and the card. Some banks present cardholders further advantages, corresponding to cashback of as a lot as 20%, reward points or air miles. Most UAE banks present their prospects handy cell banking via cell apps and SMS.

If you occur to be coping with a checking account filled with overseas currency, the trade charges provided by ATMs in Dubai are often higher than the ones you’ll find at precise currency change places of work. Typically %KEYWORD_VAR% you can have your checking account up and operating in a couple of hours if you’re a resident in Dubai. Non-residents making use of for savings accounts could take a bit longer to have their functions processed and, as a result, may not gain entry to their checking account immediately. Most main international financial establishments like Citibank will let you open an account online even from the UAE, provided you proceed to have an tackle and residency within the United States.

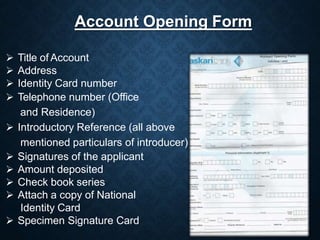

By default, banks require a passport, a resident visa (if you have resident status), an Emirates ID, an employment certificate or business paperwork. For non-residents, you will want bank statements, proof of address in your country of residence and sometimes a letter of advice from one other bank. Worldwide transactions are available for residents with financial institution accounts within the UAE. Worldwide money transfers may be made in a bank’s cellular app or on-line banking service. The paperwork required to open a financial savings checking account in Dubai UAE might embody a passport copy, residence visa, Emirates ID, and proof of handle such as a utility bill or rental agreement. For non-residents who wish to open a UAE foreigner checking account, the method is more difficult.

Your account will nonetheless be U.S. based, however you’ll have access to branches, fee-less ATMs, and financial institution tellers in Dubai. The similar can be stated for HSBC, provided you are a U.S. or UK resident. Open specialized financial savings accounts or funding accounts with competitive charges. Our bank account specialists assist you to examine account advantages throughout totally different UAE banks to search out the most effective account for your financial objectives. A private bank account in the UAE isn’t supposed for industrial operations. Banks strictly monitor transaction patterns, and utilizing a personal account for business purposes could result in requests for clarification, short-term freezing of funds, or account closure.